Technology driven personalised and preventative healthcare in Europe

Although there has been a significant growth in recent years in the understanding of the crucial role that diagnostics play in European healthcare, diagnostics firms still confront numerous difficulties in the design, development, funding, regulation, and adoption of new products. These issues have increased patient backlogs and emphasized the need for a dramatic change of diagnostic services, along with rising healthcare demands, a lack of competent personnel, and other resource shortages. Rapid advances in science, technology, and data analytics have sparked innovation and given rise to opportunities to reimagine diagnostic pathways and provide patients with a more predictive, personalized, preventative, and participatory (4P) future while also making health systems more cost-effective in the process.

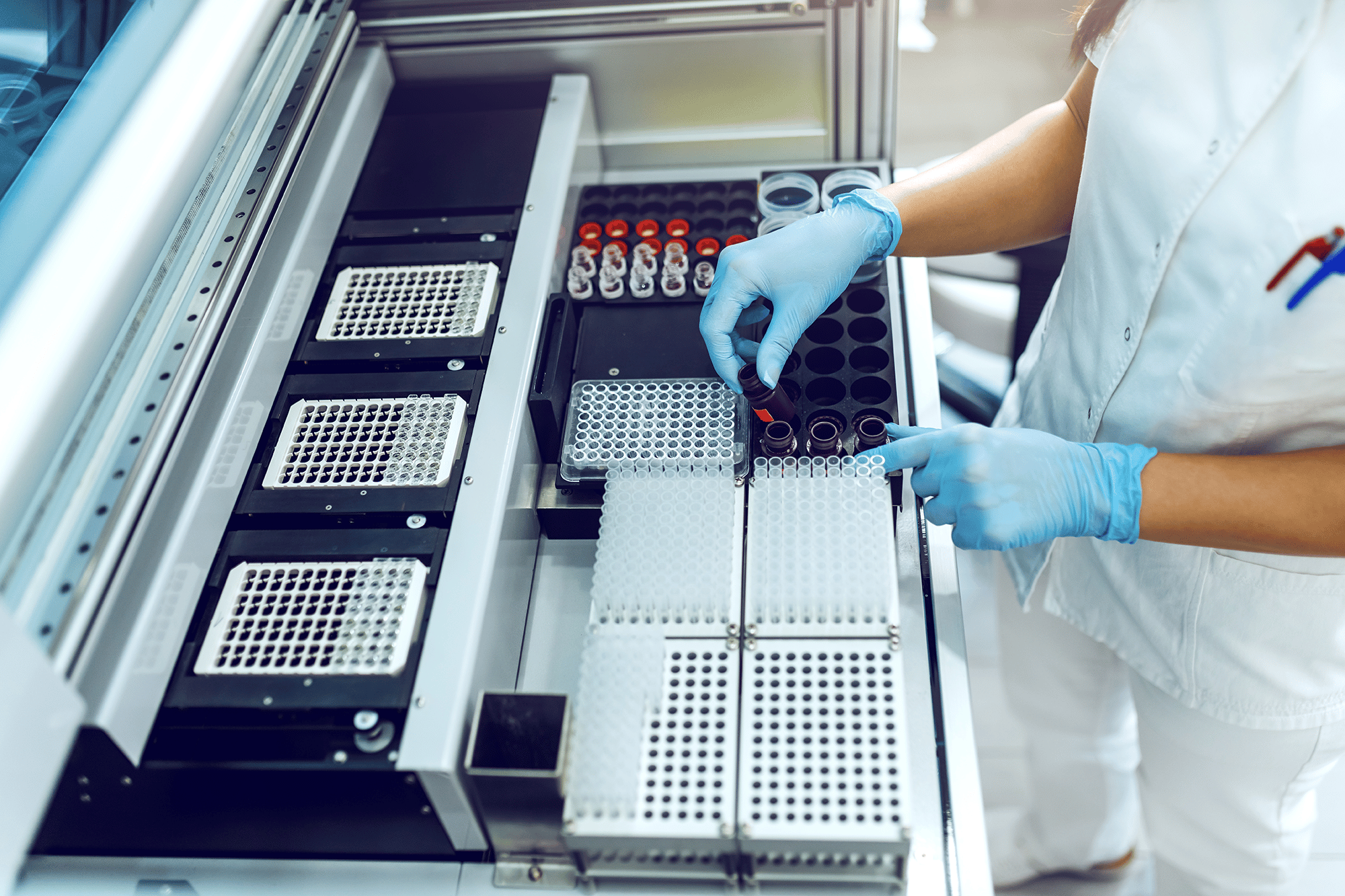

The diagnostics sector includes a wide range of diagnostic tools and procedures, from in vitro diagnostic (IVD) tests with low cost and high use to imaging tests with high value but relatively low use. Diagnostic advancements have enhanced medical care in Europe for many years. But across all care settings, an unacceptable proportion of patients have continued to suffer injury as a result of erroneous or delayed diagnosis. Today’s technological developments are revolutionizing imaging and bringing about new in vitro and digital diagnostic test kinds that can increase diagnosis’ speed and accuracy and allow for more prompt and accurate medical interventions.

The conclusions in this report are based on a thorough review of the literature, semi-structured interviews with 40 important stakeholders from across Europe, responses to a survey from 250 European diagnostics companies with at least one diagnostic product in their portfolio, responses to a survey from 751 front-line clinical staff members (clinicians), and insights from Deloitte colleagues around the world.

Reasons for changing diagnostic services in Europe

The development of more effective and efficient patient care models depends heavily on diagnostics. Demand for diagnostic services, such as imaging, pathology, endoscopy, and genomics, was rising faster than available capacity prior to the COVID-19 pandemic. The pandemic’s disruption made existing backlogs worse, making change even more necessary. Although the pandemic accelerated the development and use of new diagnostics, it also catalyzed innovation throughout the healthcare and life sciences sectors, moving diagnostic testing away from hospitals and centralized laboratories and closer to the patient. 77% of the diagnostics businesses we surveyed stated their products were already a part of this transformation, and 57% of the physicians we surveyed said they were seeing this shift. Clinicians now face a number of difficulties in getting a prompt diagnosis, however the majority believe that implementing new diagnostic technology will increase their capacity to diagnose more quickly. However, there is still more to be done because of how slowly and unevenly these technologies are being adopted and used throughout Europe.

the difficulties in creating and implementing products

Diagnostics companies encounter a variety of difficulties in developing new products, scaling up acceptance, and expanding their markets in Europe. The majority of diagnostics companies reported feeling “well” or “reasonably well” equipped to handle the difficulties involved in creating novel products, particularly those related to securing intellectual property (IP) protection and finding and keeping employees with the necessary product development and design skills.

The areas in which businesses felt least prepared were obtaining the necessary finance and resources to develop and market a product as well as assembling sufficient clinical data to support the regulatory approval procedure.

The inconsistent digital infrastructure in healthcare was the main issue diagnostics companies had to deal with when releasing a new diagnostic instrument (51 per cent of respondents). Additionally, it was determined that the most crucial change required to enhance diagnostic services was data exchange. Additionally, the regulatory approval process and healthcare cultures and attitudes toward technology-enabled digital transformation were named among the top three problems that businesses face by more than 44% of those surveyed.

Interoperability and connectivity continue to be major obstacles to digital transformation and data sharing, even while connected diagnostic devices and a developed digital infrastructure can assist the provision of timely data that enables early diagnosis and individualized treatment. The absence of standardized frameworks and standards continues to impede development in this field.

The new regulations governing in vitro diagnostics and medical devices, which went into effect in May 2021 and May 2022, respectively, provide a number of issues for businesses. Both the participants in our survey and the participants in our interviews agreed that Europe was becoming less desirable as a market for the initial release of new products because of the difficulties associated with funding innovations in diagnostics, rising development costs, growing demands for clinical evidence, and capacity constraints at Notified Bodies. Improved coordination and communication between regulators and businesses, a clear path to regulatory approval, and a focus on regulatory capacity creation are some solutions. The understanding and use of the results from new diagnostic technologies, such as wearables and at-home testing, genomics, and Al, by providers and payers must be improved in order to increase the adoption of innovation. This requires more effective collaboration between healthcare providers and industry. Additionally, diagnostics companies must give authorities and the healthcare system strong, fact-based assurances regarding the security and safety of their goods.

The value that diagnostic testing may deliver currently falls well short of the capital that investors appear willing to commit. To assist manufacturers in securing funding for the creation and introduction of their products, a pan-European ecosystem is required. Manufacturers also need to know the best ways to convince investors before the market launch of the value of their invention.

The epidemic, Brexit, and geopolitical unrest are all having a huge influence on supply chain concerns, which are also having a significant impact on European firms. Our interviewees revealed that businesses had created a number of tactics, such as larger levels of inventories and access to several sources for materials and components, to protect their supply chains.

Future demands for greater product traceability and worldwide efforts to achieve net zero are also anticipated to have a significant impact on supply chains.

Furthermore, there are substantial personnel shortages throughout Europe’s healthcare systems, notably in the fields of pathology and radiology. Adopting new diagnostic tools can increase productivity and allow clinicians to determine diagnoses and treatments more quickly and accurately. One of the main obstacles to technology adoption, according to the clinicians we questioned, is a lack of staff training and expertise in new technologies. Although such training should be provided by healthcare systems, diagnostics businesses might assist by making sure they offer the right learning resources, on-demand support, and on-site training.

A new diagnostic model that supports 4P medicine

The way diseases and other deficits and abnormalities are prevented, detected, and treated is changing as a result of disruptive technologies working in tandem with scientific and technological advancements. The diagnostics landscape is continually changing, and in recent years, the rate of change has quickened. The fourth industrial revolution is now being experienced by the diagnostics sector. Smart laboratories and smart imaging systems are emerging as a result of digitalization, robotization, and automation. These systems can easily meet the rising demands from healthcare providers and customers at a faster rate and at a cheaper cost.